Article by Maria Brito

If you are purchasing a property while working with a brokerage that provides buyer rebates, you could be receiving thousands of dollars after the completion of your purchase. That’s probably why you’ll hear the words “cash back” often associated with buyer rebates, which are also known more officially as commission rebates.

But there’s a bit more to consider on this subject. Let’s explore the 6 most common questions buyers often have surrounding buyer rebates.

1. Are commission rebates legal?

But of course, it’s legal, across Canada anyways. That said, some U.S states do not yet permit rebates. Many who oppose the rebate ban in those non-rebate states say it limits competition by allowing more traditional brokerages to unfairly prop up the cost of commission which in the end may have the effect of causing harm to consumers. In fact, the U.S Federal Trade Commission says that commission rebates “save consumers hundreds and often thousands of dollars per transaction”. Of course, lots of rules do exist at the provincial level on how brokerages can promote the availability of rebates.

2. Where does the rebate come from?

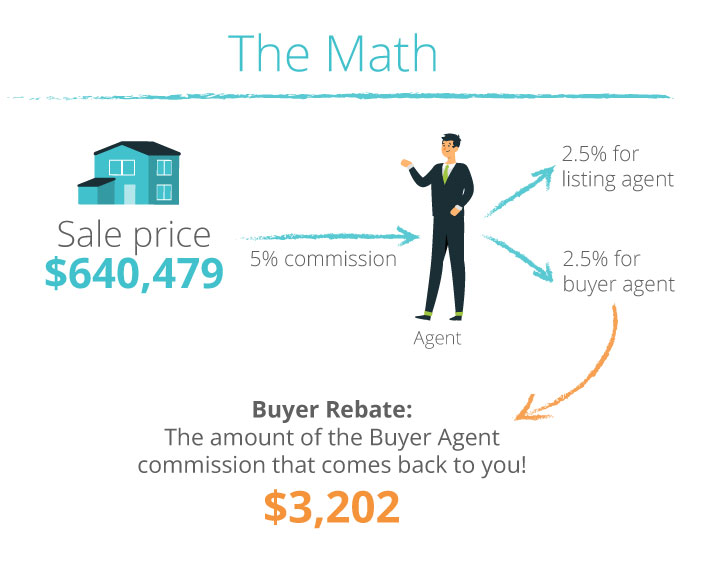

This is a great question, one that’s highly misunderstood. That’s because most of us have all heard at some point – whether true or not – that it’s FREE to use a buyer agent. But is that statement entirely accurate? I’ll let you decide. First, you’ll want to consider that when you purchase a property listed through an agent, a portion of the sale price typically goes toward the commissions owed to the agents involved. Quite often, the listing agent shares a portion of their commission with the buyer agent. As an example, if the total commission owed from a seller was 5%, it would be common for the commission split to be 2.5% for the listing agent and 2.5% for the buying agent. In the illustrative example below, the Commission Rebate would come from the portion being paid to the buyer agent. So in theory, and because the commission is most often included in the final sale price, a commission rebate could be viewed as the buyer simply getting some of their own money back from their purchase… that make sense?

*In the example above, a commission rebate of 20% of the buyer agent’s commission would generate $3202.00 back to the buyer. This example is for illustrative purposes only as commissions in Canada are negotiable. The example is based on the Canadian average sale price of $640,479 for September 2022

(source: Globalnews.ca)

3. Is it the same when buying a private sale?

No, but that’s a great question. With a private sale, buyers and sellers can often connect directly without agents which can allow both parties to completely avoid the cost of commission entirely. When agents are not involved in a transaction there’s no commission to be paid – so there’s obviously no commission rebate available to share.

4. Why do some brokerages offer commission rebates?

The simple answer is that providing rebates is a good way to attract more customers. After all, isn’t that a strategy employed by many great retailers to attract more customers? They attract customers by creating limited offers, by providing incentives while also using all kinds of other discounts and promotions to ring up more sales… so it’s no different in real estate. While there are likely a few different business reasons for offering rebates, most likely do it because rebates specifically appeal to those buyers that they aim to serve. These value-seeking buyers represent an important and even growing segment of the market. After all, who wouldn’t want to receive what could be considered FREE MONEY after a purchase? I know I sure would.

5. Are buyer rebates taxable?

Generally, no, a buyer rebate is not considered the same as earned income by CRA. This article contemplates a simple residential purchase by an individual purchasing from an individual and not a corporation. But certain exceptions may exist, so please make sure that you speak to a tax professional in order to better understand how a buyer rebate can affect your particular situation.

6. How can buyers find agents who provide rebates through their brokerage?

It’s important for buyers to do their own research to be comfortable with their final decision. A quick online search can help buyers easily establish that the practice of giving buyer rebates is not so common among most brokerages. For the ones you do find, you’ll discover that the amount of rebate offered varies from brokerage to brokerage as do the terms and conditions relating to the eligibility of receiving a commission rebate. That said, there’s a brokerage that we know of that offers a commission rebate program for buyers. The feedback we receive from users about their BuyerPro service is amazing. Their name is PG Direct Realty Ltd. Brokerage. If you would like to know more about their BuyerPro program and how their commission rebates could benefit you – you can reach out to them directly at info@pgdirectrealty.com.

What is my final take on buyer rebates? There are a number of factors buyers should consider when choosing a buyer agent. I’m not sure about you, but the opportunity to receive cash back from a commission rebate when purchasing would definitely be of interest to me. Key factors to be considered are their level of professionalism, their experience, and their knowledge of the market. But above all, buyers should always choose a buyer agent that they are totally comfortable dealing with. Once those elements are considered, choosing a buyer agent who provides commission rebates through their brokerage could represent a sound financial decision. I think commission rebates are a great way for buyers to recuperate much of their closing costs, pay for expenses relating to their move or even pay for a well-deserved holiday. Those are just some ideas of what buyers could do with their rebates. But when it comes to rebates, there’s just no wrong or right answer on how to spend it. So enjoy!

About the Author: Maria Brito is a real estate enthusiast with PropertyGuys.com. She can be reached at mbrito@propertyguys.com.

About PropertyGuys.com: PropertyGuys.com Inc. is a private sale franchise network and marketplace. Each PropertyGuys.com franchise is independently owned and operated (collectively “Us” or “We”). We represent neither the buyer nor the seller and we are not licensed to trade in real estate. We neither warranty nor make any representations as to the outcome of a property sale and we do not warrant or guarantee the services provided by third parties. © 2022/2023 PropertyGuys.com Inc., All Rights Reserved.

Legal disclaimer: The subject matter developed within this article is only intended to provide general information and is for general informational purposes only. The contents do not constitute advice, are not intended to be a substitute for professional advice, and should not be relied upon as such. You should always seek legal advice or other professional advice in relation to any legal or financial decisions that you intend on making.